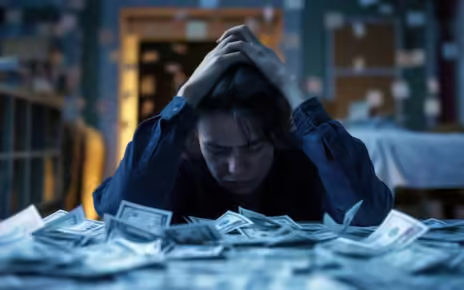

Having credit cards, store cards and loans taking up most of your mind space is not a happy state of mind. The struggle to make those debt payments may become bearable if you opt for a best debt management plan.

You have spent money and bought things that you needed for your chosen lifestyle. You bought for yourself and for your loved ones, family members, relatives or friends. Maybe, all those things you bought were not really impulsive decisions. But what did end up in your life as a result of all this spending is a fair amount of debt.

You used credit cards, store cards and even loans and all of them have added up to give you a good headache now. How do you get out of this pain?

One way out for you could be a best debt management plan (DMP)

What is a Debt Management Plan & How Does It Help

You can consider a debt management plan (DMP) as a kind of informal agreement. This informal agreement is between you and all your creditors so that you can pay back all the non-priority debts that you have accrued.

To make things clearer, non-priority debts include credit cards, store cards and loans. What happens in a DMP is that you get to pay back all your debt with one set payment done on a monthly basis.

This monthly payment is divided between all your creditors. Keep in mind that there is a DMP provider who manages most DMPs. This DMP provider is the entity that deals with those creditors of yours. You don’t have to deal with those creditors yourself.

The other thing that you need to know is that a DMP isn’t legally binding. This means there is no minimum period over which you are tied in. You can cancel a DMP any time.

Will a DMP Serve You Well?

A debt management plan can serve your debts properly and be a good option for you in the following conditions:

1- If you are managing your living expenditure well and have priority debts like mortgage, rent and council tax and the monthly repayment done on those debts is affordable for you. But it is a struggle to make payments for your credit cards and loans, then a DMP will help.

2- You don’t want to deal with creditors yourself and prefer someone else to take care of this aspect, then a DMP will help.

3- You want to make one set monthly payment that will help you to budget your expenses, then a DMP will help.

What is the Impact of a DMP?

Once you get into a debt management plan, you have to understand its impact on you.

1- Your creditors can refuse to cooperate. They can even continue to contact you.

2- The DMP could show up on your credit record. This may make it harder for you to get credit in the future.

You may find that it is taking longer to pay back your debt. This is because you are paying less each month.

3- Talk to your DMP provider and understand the details. Take the right decision. Then you can go ahead with your debt management plan.

Why not subscribe to our newsletter and keep in touch. We cover sectors like insurance, debt, energy and claims in the UK. We would love to hear your own opinions on our posts.

You can even comment below about this post. We are listening. Go ahead.